Retirement Village Financial Planning

Initial Meeting Information

Hi and thanks for contacting Retirement Village Financial Advice.

Here’s what you can expect from our first meeting.

A clear explanation of Retirement Villages, fees, tips, tricks and how they apply to you. Receiving unbiased advice from a Third Party Professional with no ties to any Retirement Village, just answering any and all questions asked, holding nothing back.

Retirement Village Financial Planning

Initial Meeting Information

Hi and thanks for contacting Aged Care Financial Planning.

Here’s what you can expect from our first meeting.

A clear explanation of the Aged Care System and how it applies to you and your family. Receiving unbiased advice from a Third Party Professional with no ties to any Aged Care Home, just answering any and all questions asked, holding nothing back.

WHAT WE WILL COVER

Our meeting will involve talking about and an explanation of options such as:

What is a Retirement Village?

What are Land Lease Communities?

Types of AccomodationAccommodation

Breaking down the costs

We will also cover the answers to most frequently asked questions

at this stage such as;

How much are you paying for your Retirement Village?

What is your security of tenure? Under what circumstances can you be required to leave?

How are the ongoing fees determined?

What are your rights and responsibilities in refurbishing the home when you leave?

Once, you've got an understanding of the topics listed above, we’ll move on the

next step.

We’ll look on how to breakdown the different Retirement Village costs, such:

- The ingoing cost

- The ongoing cost

- The outgoing cost

And More importantly - what it all looks like for your situation and a clearer idea of what you can afford and what it will look like for you longer term.

We'll Cover Some of the other "basics" such as:

- What is a Retirement Community

- Difference between a Retirement Village and a Land Lease Community

- What are the Centrelink impacts?

- What care options are available as your needs change?

- What happens if I need Aged Care later on?

- What are some of the tips?

- What are some of the traps?

- What do other family members need to know?

We'll leave you less stressed and confident after having a neutral third party explain what's ahead of you.

WHAT WE WILL COVER

Our meeting will involve talking about and an explanation of options such as:

What is a Retirement Village?

What are Land Lease Communities?

Types of AccomodationAccommodation

Breaking down the costs

We will also cover the answers to most frequently asked questions at this stage such as;

How much are you paying for your Retirement Village?

What is your security of tenure? Under what circumstances can you be required to leave?

How are the ongoing fees determined?

What are your rights and responsibilities in refurbishing the home when you leave?

Once, you've got an understanding of the topics listed above, we’ll move on the next step.

We’ll look on how to breakdown the different Retirement Village costs, such:

- The Ingoing Costs

- The Ongoing Costs

- The Outgoing Costs

And More importantly - what it all looks like for your situation and a clearer idea of what you can afford and what it will look like for you longer term.

We’ll look on how to breakdown the different Retirement Village costs, such:

- The Ingoing Costs

- The Ongoing Costs

- The Outgoing Costs

And More importantly - what it all looks like for your situation and a clearer idea of what you can afford and what it will look like for you longer term.

We'll Cover Some of the other "basics" such as:

- What is a Retirement Community?

- Difference between a Retirement Village and a Land Lease Community

- What are the Centrelink Impacts?

- What Care options are available as your needs change?

- What happens if I need Aged Care later on?

- What are some of the tips?

- What are some of the traps?

- What do other family members need to know?

We'll leave you less stressed and confident after having a neutral third party explain what's ahead of you.

ABOUT ME

My background

- Specialist in Aged Care and Centrelink

- I've been through this process with over a thousand families, including my own

- Sought after for Education and Training delivery in Aged Care matters across Australia

- Head of Membership for the Association of Aged Service Professionals

My reason

I started in Aged Care Advice when my Grandmother went into care. I became an Aged Care specialist because I needed the answers for own family - not because I already had them. I basically don't want any family to experience what we did and have someone they can turn to who can give them the no BS answers without worrying about the independence of the advice.

Qualifications

- Bachelor of Commerce (Finance and Economics) - Monash University

- FPA Aged Care Specialist

- Accredited Aged Care Professional

- Certified Financial Planner

- ASX Listed Product Adviser

ABOUT ME

My background

- Over 12 years in Army Intelligence

- Financial Planner

- I have been through this process with over a thousand of families, including my own.

- Head of Membership for the Associated of Aged Service Professionals

My Reason

- I started in Aged Care Advice when my Grandmother went into care. I became an Aged Care specialist because I needed the answers for own family - not because I already had them. I basically don't want any family to experience what we did and have someone they can turn to who can give them the no BS answers without worrying about the independence of the advice.

Qualifications

- Certified Financial Planner

- ASX Listed Product Adviser

- Bachelor of Commerce (Finance and Economics)

- Accredited Aged Care Professional

- Financial Planning Association of Australia - Aged Care Specialist

What we do?

- Explain the different Retirement Village options

- Guide you through the different fees in Plain English

- Help you understand your contract, rights and obligations

- Maximise your Aged Pension and make sure you get all the Care Assistance you are entitled to

- Do the sums so you know what you can afford

WHAT WE DO

- Explain the different Retirement Village options

- Guide you through the different fees in Plain English

- Help you understand your contract, rights and obligations

- Maximize your Aged Pension and make sure you get all the Care Assistance you are entitled to

- Do the sums so you know what you can afford

WHAT’S ALL THIS GONNA COST ME?

1. Costs associated with the appointment

$795 for a virtual meeting that brings all the family members together and on the same page

Ask all the questions you want - if you wish to set yourself up to do things yourself, tell me! I'll let you know exactly what I would do in the situation and set you up for success.

If further advice/assistance is needed (such as becoming your Centrelink nominee etc.) , I’ll let you know exactly what the costs will be beforehand so you can make a decision as a family in your own time.

I try to keep things as simple as I can, but it can be overwhelming. We can also share a copy of the meeting recording to digest more later or share with family.

2. Click the link below to book a meeting at a time convenient for you and the family. If you can't find a time that

suits, give us a call on 1300 000 243 (1300 000 AGE).

After choosing your appointment date, we will present you with a survey. Our time together is extremely valuable. By completing this pre-meeting survey, we will be able to discuss your strategies rather than gathering information. We know people have commitments and how important it is to involve all the relevant family members in the decision making. Business hours, after hours and weekend appointments available on request. Our industry leading technology allows us to meet with you anywhere and anytime within Australia.

WHAT’S ALL THIS GONNA COST ME?

1. Costs associated with the appointment

- $595 for a virtual meeting that brings all the family members together and on the same page

- Ask all the questions you want - if you wish to set yourself up to do things yourself, tell me! I'll let you know exactly what I would do in the situation and set you up for success.

- If further advice/assistance is needed (such as becoming your Centrelink nominee etc.) , I’ll let you know exactly what the costs will be beforehand so you can make a decision as a family in your own time.

- I try to keep things as simple as I can, but it can be overwhelming. We can also share a copy of the meeting recording to digest more later or share with family.

2. Click the link below to book a meeting at a time convenient for you and the family. If you can't find a time that

suits, give us a call on 1300 000 243 (1300 000 AGE).

We know people have commitments and how important it is to involve all the relevant family members in the decision making. Business hours, after hours and weekend appointments available on request. Our industry leading technology allows us to meet with you anywhere and anytime within Australia.

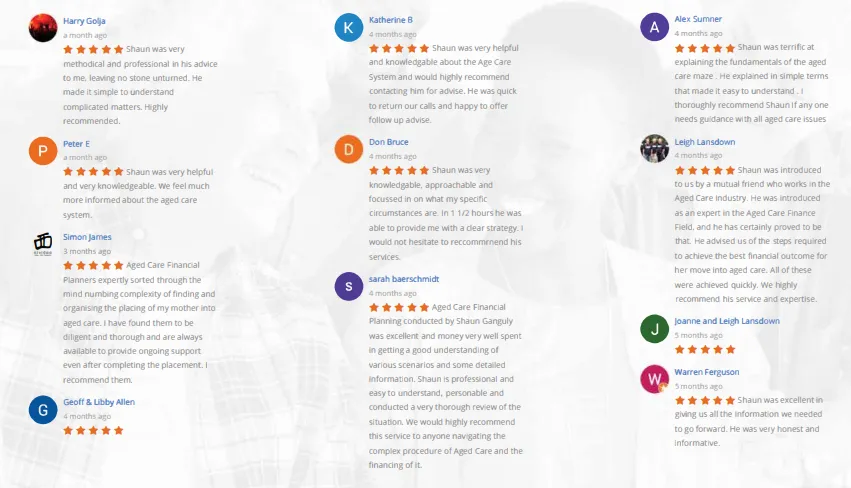

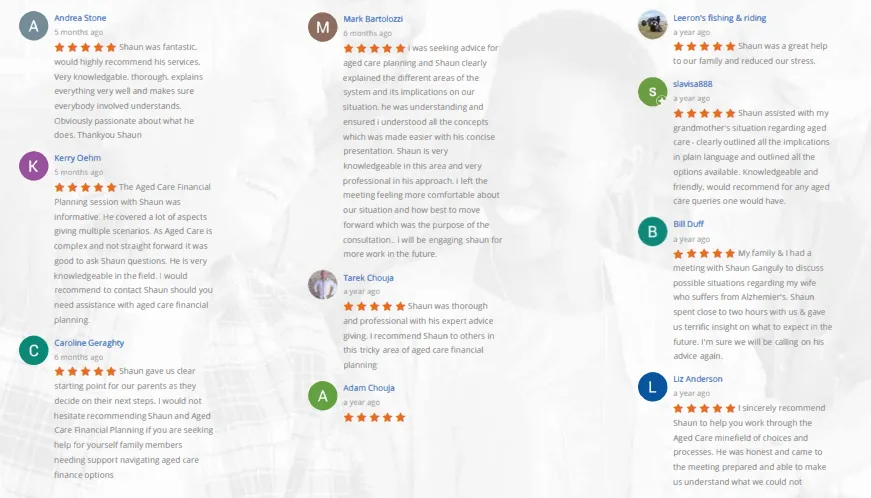

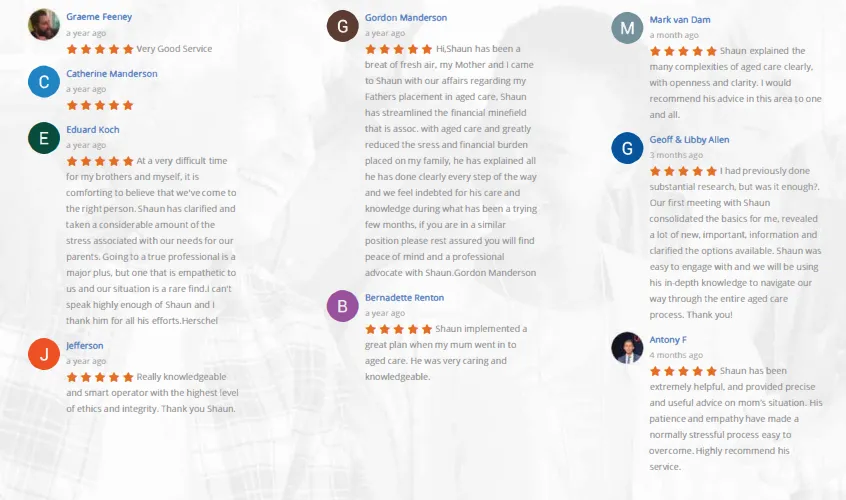

WHAT PEOPLE SAY ABOUT US

VIDEO TESTIMONIALS

Bill

Julie and Ann

Terry and Wendy

Felicity

Here are some reviews left for us on Google: